These PBM programs are getting so complex and there are so many new program names it’s getting very confusing understanding each one, how they are different, and how they impact patients.

It’s easy to think that Copay Accumulator & Maximizer programs might just be different names for the same program. But there are some differences.

The New England Hemophilia Association (NEHA) and the New England Bleeding Disorders Advocacy Coalition (NEBDAC) hosted an education webinar to help our community members better understand what copay accumulators and maximizers are. These harmful programs allow Pharmacy Benefit Managers to draw down the full value of the co-pay manufacturer card while still requiring the patient. Copay Maximizers Similar to copay accumulator adjustment programs is the copay maximizer. In these programs, the manufacturer copay assistance maximum is applied evenly throughout the benefit year but still does not count toward the patient’s deductible and out-of-pocket maximum.

Copay accumulators and copay maximizers are payer-imposed utilization management practices. With either program in place, a drug manufacturer’s copay assistance (usually a drug coupon or card that a patient brings to their pharmacy to obtain a discount on their cost-sharing) no longer applies toward a patient’s deductible or out-of-pocket. Drug manufacturers and third party funding programs offer copay assistance funds when the costs are too high on certain medications, insurance companies that utilize a copay accumulator or copay maximizer option are basically saying that assistance will not apply toward your out of pocket maximum or copay amount and you still have to pay that full amount down from that assistance. Plans have also developed maximizers - sometimes called variable copay programs - that are similar to accumulators but have important operational differences. With a maximizer program, the plan increases a drug’s copay amount so that it approximates the coupon’s monthly value and the value of the coupon is then applied evenly throughout the.

In cruising the web, I came across an interesting article by John Linehan from JD Epstein Becker & Green, called “Assessing the Legal and Practical Implications of Copay Accumulator and Maximizer Programs”. In it he lays out the subtle differences between the two programs:

“Under copay accumulator programs, the plan prevents the coupon from counting against the beneficiary’s deductible or out-of-pocket maximum. Upon exhaustion of the coupon’s value, the beneficiary must pay the entire amount of his or her deductible before plan benefits kick in.

Under a copay maximizer (also called a variable copay program), the plan increases the copay amount for a drug so that it approximates the copay coupon’s monthly value. The total value of the coupon is applied evenly throughout the benefit year but does not count against the beneficiary’s cost-sharing obligations.”

In my eyes both of these programs get the patient to a place they don’t want to be….a higher out of pocket cost! I mentioned in my last blog article that some states led by advocacy groups are pushing back and starting to adopt legislation to prohibit PBM’s from preventing drug manufacturer coupons and co-pay assistance from counting towards a plan’s deductible or OOP limit.

John also mentions “These programs present unique legal and practical issues, which, if not properly managed, could lead to negative consequences for plans and their beneficiaries. Copay accumulator and maximizer programs remain in a legal gray area. This is because of their recent origin, the lack of existing precedent, and the fact that the legal analysis is highly dependent on a program’s unique facts and structure. Plans and sponsors seeking to maximize compliance would be well served to ensure that they adequately disclose the nature and effect of copay accumulator and maximizer programs to beneficiaries.”

How will it all shake out? Only time will tell…but in the meantime, it’s important that pharmaceutical companies continue to monitor the impact of accumulator and maximizer programs on their brands and to stay informed on this evolving issue.

Any way you look at it, PBMs are exploiting programs that have been put into place by manufacturers to make medicine more accessible to patients. George Frey/Getty Images

Rhetoric counts. What’s in a name? The indication of what we want something to mean, to represent, to be. So, when it comes to insurance copays—to be or not to be, that is the question. And today’s question is, what is a copay maximizer?

Some readers will have heard about copay accumulators: a tool used by pharmacy benefit managers (PBMs) to punish patients who have the nerve to use prescription drugs by ensuring that manufacturer coupons don’t count towards fulfilling copay requirements. Accumulators are so perverse and pervasive that many states have already passed laws banning them and more legislation is undoubtedly on the way. (These pieces of legislation have had broad, bipartisan support. In the final week of March 2019, the governors of Virginia and West Virginia signed bills into law to curb accumulators, and Arizona passed a similar law on April 11, as did Washington on May 1.) Patient advocacy groups are lobbying lawmakers and petitioning state insurance agencies to review these PBM programs to determine whether they violate consumer protection rules.

But have you heard about the copay accumulator’s twin sibling, the copay maximizer? It’s the newest in a series of schemes PBMs have put into place to enhance their already plentifully padded bottom lines at the expense of appropriate care and patient choice.

Also known as variable copay programs, copay maximizers increase the copay amount for a drug so that it mirrors the coupon’s monthly value. The total value of the coupon is applied evenly throughout the benefit year but does not count against a patient’s cost-sharing obligations. The result, as with accumulators, is that PBMs reduce their financial liability by leveraging the value of the coupon and the beneficiary cost-sharing amounts. In short, maximizers raise copays for patients using coupons.

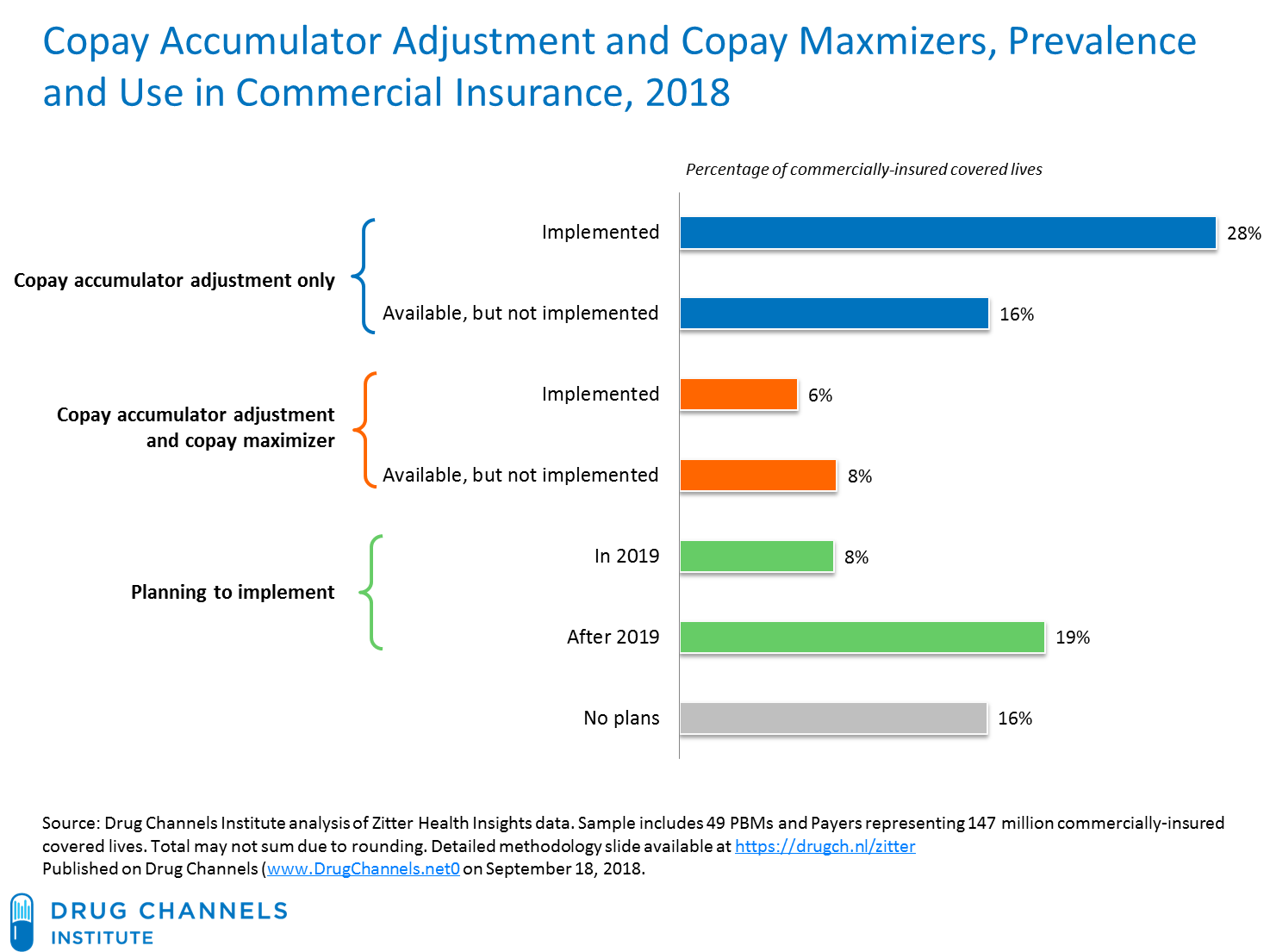

According to research from Zitter Health Insights, more than a third of commercially insured individuals are enrolled in health plans that have implemented accumulators or maximizers. A survey by the National Business Group on Health found that about a quarter of employers currently utilize these programs and as many as half plan to do so in the next two years. So far, accumulators have had greater uptake among plans than maximizers, largely because accumulators are less complex and are capable of achieving greater cost savings.

In contrast to accumulators, maximizer programs have more varied and flexible designs that can be tailored to apportion costs. Regardless of the selected program design, health plans should consider supplementing their programs with beneficiary outreach regarding the effects of the programs, as well as any less-costly alternatives or charity assistance options.

As Adam Fein, CEO of Drug Channels Institute, pointed out, “Manufacturers have stepped up with more financial support to shield patients from the worst aspects of these benefit designs.” This support further inflates the gross-to-net bubble, the $166 billion pile of money that sits between a manufacturer list prices for a drug and the net price after rebates and other reductions.

According to Zitter Health Insights’ research from 49 plans and PBMs with 147 million covered lives, almost 60 percent of commercially-insured patients are enrolled in plans that have the capability to implement one of these two approaches, and an additional 28 percent of lives are projected to face accumulators and/or maximizers in 2019 and beyond.

Copay Accumulator Adjustment and Copay Maximizers, Prevalence and Use in Commercial Insurance, 2018

Copay Maximizers

Is ‘Less Worse’ the Best We Can Do?

Whether you are accumulating or maximizing, both scenarios combine many of the worst aspects of our dysfunctional drug channel system:

- Unreasonable out-of-pocket costs for patients;

- High list prices for specialized therapies;

- Hidden rebates retained by plan sponsors;

- Manufacturer copay programs that offset skewed benefit designs; and

- Patients who may not be aware of changes to their benefit designs.

Any way you look at it, PBMs are exploiting programs that have been put into place by manufacturers to make medicine more accessible to patients. PBM tactics such as maximizers and accumulators undermine these efforts by eliminating their role as copay assistance opportunities. The bottom line is that these programs are in place to negate the effects of discount cards and leave patients little choice but to seek less expensive treatments.

Copay Accumulator Vs Maximizer

Whether you’re talking about accumulators or maximizers, the result is the same—maximizing accumulation for PBMs—to the detriment of patients.

Copay Accumulator Pdf

Peter J. Pitts, a former FDA associate commissioner, is president of the Center for Medicine in the Public Interest and a visiting professor the University of Paris Descartes Medical School.